Tom Francis, our Head of Advice, breaks it all down.

Elections are a natural part investing, there’s nothing new here.

Dubbed the “Super Bowl” of global politics, we now know who will be leading the largest economy in the world over the next four years. Donald Trump will return as US President, with a surprisingly comfortable victory over Kamala Harris. We won’t wade into the weeds of why he was elected here, but we will take a look at what this might mean for your investments.

To set the investment scene, what happens in the US has an impact on pretty much every other economy and stock market in the world. If the whole world was a single fund, then the US would make up about 60% of the total value. It’s for this reason that most portfolios (including the Octopus Money ones) have a big allocation to the US.

So, what does a Donald Trump election actually mean for investments?

The usual disclaimers to begin. No one actually knows the exact impact. If someone claims to know, they’re probably fibbing, or overly confident. The reason no one can be certain is twofold:

Firstly, we don’t know exactly what Donald Trump will do in terms of new policies, and also whether this will be approved by Congress. We have an idea, but that’s all.

Secondly, investment markets are extremely efficient. This means that they are already “pricing in” hundreds of potential outcomes from the result of this election, including the indicated policies which Donald Trump might go on to enact.

So, what does a Donald Trump win potentially mean for investments?

There are specific sectors which might benefit from a Trump election. These include fairly traditional areas, like production companies making things like cars and heavy goods. Trump has also indicated support for (or comfort with deregulating) sectors like Tech, Banks and Energy.

Trump has also been quite vocal about imposing tariffs on imports. This could have a negative impact on regions like Europe and Asia, as their products and services might become more expensive for the high-consuming population of the US.

What should you do about it?

If your financial goals and circumstances haven’t changed – nothing! Elections, and any volatility they bring, are a natural part of investing. With Octopus Money you are invested in a well diversified portfolio made up of countries around the globe. Make sure your level of risk is right for you, and drown out the noise.

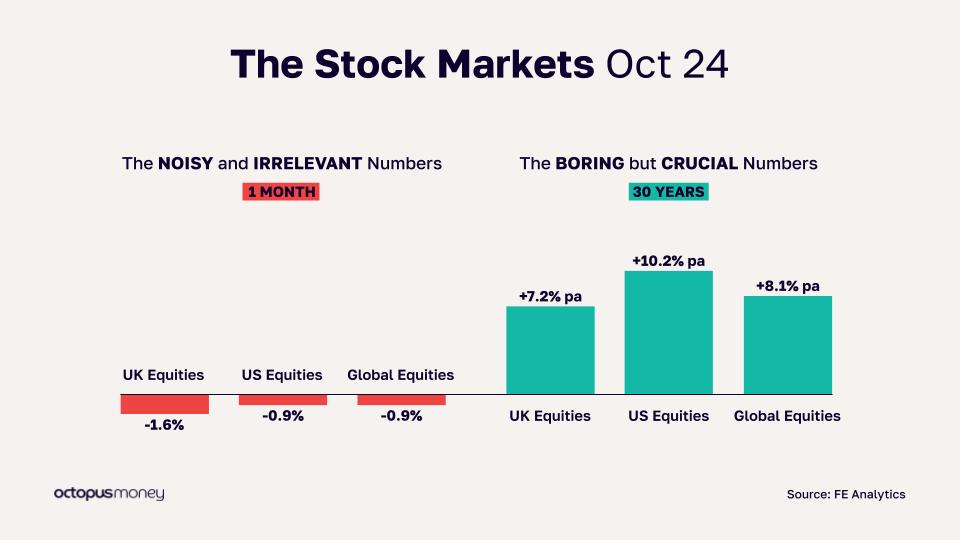

As you’ll see in the image below, the day-to-day (or even month-to-month) movements of the markets aren’t that important in the grand scheme of things. It’s consistent investing over the long term – year in, year out – that really matters.

*With investing your capital is at risk. Your investments may go down as well as up, and you may get back less than the amount you invested.