They say size doesn’t matter.

But when it comes to your pension pot, it absolutely does. Because the size of your pension pot determines the type of lifestyle you’ll be leading in retirement.

Here are 5 mistakes that 99% of us are probably making when it comes to our pensions.

- Not thinking through the amount that you want to have in retirement

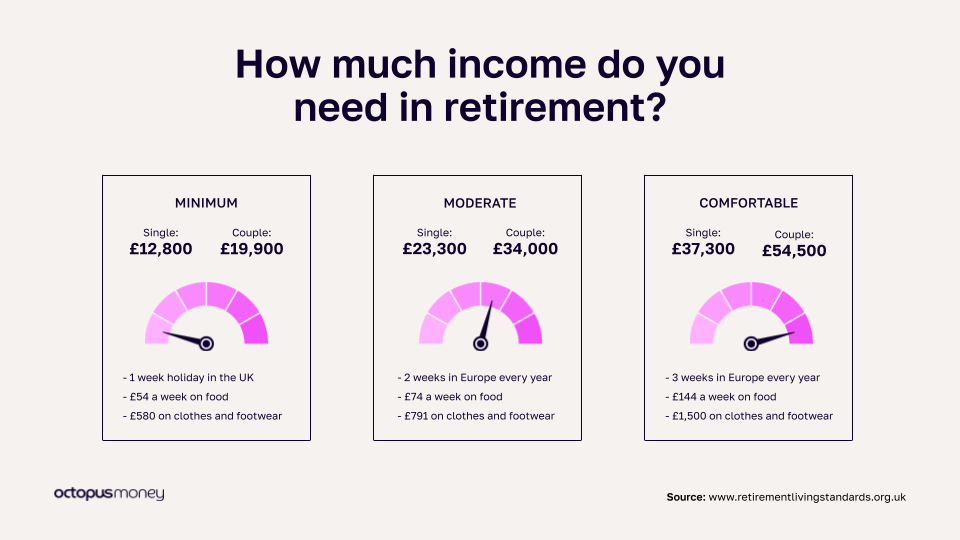

The Pensions and Lifetime Savings Association categorises pension lifestyles into three types: minimum, moderate and comfortable. Depending on what your ultimate retirement goals are, you should figure out approximately how much money you’ll need each year in retirement. Once you have this figure, you can see if you’re on track or not by checking your workplace pension pot and your National Insurance (NI) contributions.

- Not getting your State Pension forecast

Your State Pension is going to fund your retirement, at least in part. A lot of people wonder if they’ll benefit from this by the time they reach retirement age. And it’s true that policies may change in the future. But we still need to plan for it, and the NI contributions are coming out of your monthly paycheck regardless.

It might be helpful to think of the State Pension as a type of diversification of your funds. It’s no different to money coming in from a different income stream. And a huge benefit of the State Pension is the triple lock, which means that the amount pensioners receive increases in line with inflation each year.

So once you’ve worked out how much money you want to have in retirement, you’ll need to check your State Pension forecast.

You can check your State Pension forecast online by signing in with Government Gateway. Or you can get this information from the government’s Future Pension Centre. You’ll need to phone them up and give them your National Insurance number, and they’ll pop a pension forecast in the mail for you. Once you receive that, you’ll know if you’re on track for a full State Pension or if you need to think about plugging any gaps.

- Overlooking the value of your employer’s matched contributions

The State Pension alone isn’t enough, especially if you want to have more than a minimum lifestyle in retirement. So you will likely need to supplement with a workplace pension and/or a private pension to have the kind of lifestyle you want.

Make sure you log in to your workplace pension and check your monthly pension contributions. If you aren’t already, make sure you’re taking full advantage of your employer’s matched contributions, because those contributions are tax-efficient and it’s free money! It’s also super satisfying to see that pension pot grow over time.

- Not using pension contributions to reduce your net income (if you need to)

If your career progression or your annual bonus has taken your salary into the higher tax band of 40%, you might want to consider putting more into your pension to reduce the amount of taxable income you get. This will also allow you to retain more of your child benefits, which you might otherwise lose access to by being in a higher tax bracket.

- Not keeping track of your pensions

There’s around £26.6bn worth of lost pension pots in the UK according to the Pensions Policy Institute. Since auto-enrolment made contributing to a workplace pension easier, if you’ve had a few jobs, and you haven’t kept track of your pensions, some of this money might be yours. You can use the government’s Pension Tracing Service as a starting point to find any lost pensions you might have.

By consolidating all your pensions in one place, they’re not only easier to keep track of, but you’ll also get the benefits of a larger sum of money compounding over time.